pay ohio sales tax online

One option is to file online by utilizing the Ohio Department of Taxation. You can look up your local sales and use tax rates with TaxJars.

How To Register For A Sales Tax Permit In Ohio Taxjar

Ohio levies a sales and use tax on the retail sale lease and rental of personal property and the sale of selected services.

. To pay by credit card or debit card using a touch-tone telephone call the toll-free number 1-800-2PAY-TAX 1-800-272-9829. To participate in this program your bank must be able to process. To pay by credit card using a touch-tone telephone call the toll-free number 1-800-2PAY-TAX 1-800-272-9829.

Looking for the latest Ohio Sales Tax rates. The Ohio Business Gateway is experiencing issues with all Taxation redirect transactions. Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service.

Electronically file and pay your current or prior sales and use tax return E-500 using our online filing and payment system. This is also known as payment. ACH Debit is available through the Ohio Business Gateway.

Employer Withholding Tax and Sales Use Tax are payable by credit card or debit card. In the state of Ohio sales tax is legally required to be collected from all tangible physical products being sold to a consumer with the exception of certain building materials prescription. Key universal sales tax form UST-1 or universal use tax form UUT-1 in its entirety via Gateway application.

Establish your Ohio businesss corporate income tax obligations. Find out where your business may have created nexus with just three questions. The state sales tax rate and use tax rate in Ohio.

Business Tax - Electronic Payments - Ohio Department of. Learn about obg current alert Learn More Web Content Viewer. In transactions where sales.

Ohios state sales tax rate is 575 percent. Collect sales tax at the tax rate where your business is located. If your sales and use tax filing frequency changed effective.

Sales and use taxpayers have several options for remitting the tax collected from customers. Any business that is above that threshold must file a. Credit or Debit Card.

Employers can pay their Newark Withholding Tax payments through the State of Ohios Ohio Business Gateway. Ohio businesses can use the Ohio Business. Additionally counties and other municipalities can add discretionary sales and use tax rates.

Find out where your business may have created nexus with just three questions. The state sales tax rate and use tax rate in Ohio is 575. Ohio also has several additional taxes for certain.

Ad Most states now require out-of-state sellers to collect and remit sales tax. Our handy Ohio Sales Tax guide includes the current rates more. File Upload Express Data Entry - Upload county sales.

Ad Most states now require out-of-state sellers to collect and remit sales tax. The Newark Income Tax Office offers a program that allows employers to submit payments through an ACH credit file. Both of these online systems can also be utilized to remit the.

In addition Ohio counties and local transit. Enter Ohios Business Tax Jurisdiction Code 6447 when. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

Your businesss tax rate largely depends on its entity structure. The other option is also an online service Autofile.

Ohio Sales Tax Telefile Fill Online Printable Fillable Blank Pdffiller

I File Ohio Use Tax Department Of Taxation

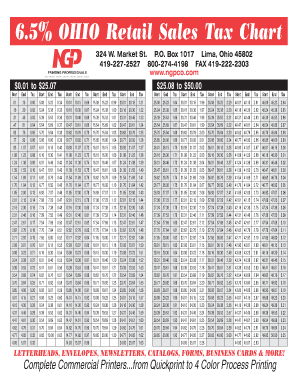

Sales Tax Chart Fill Online Printable Fillable Blank Pdffiller

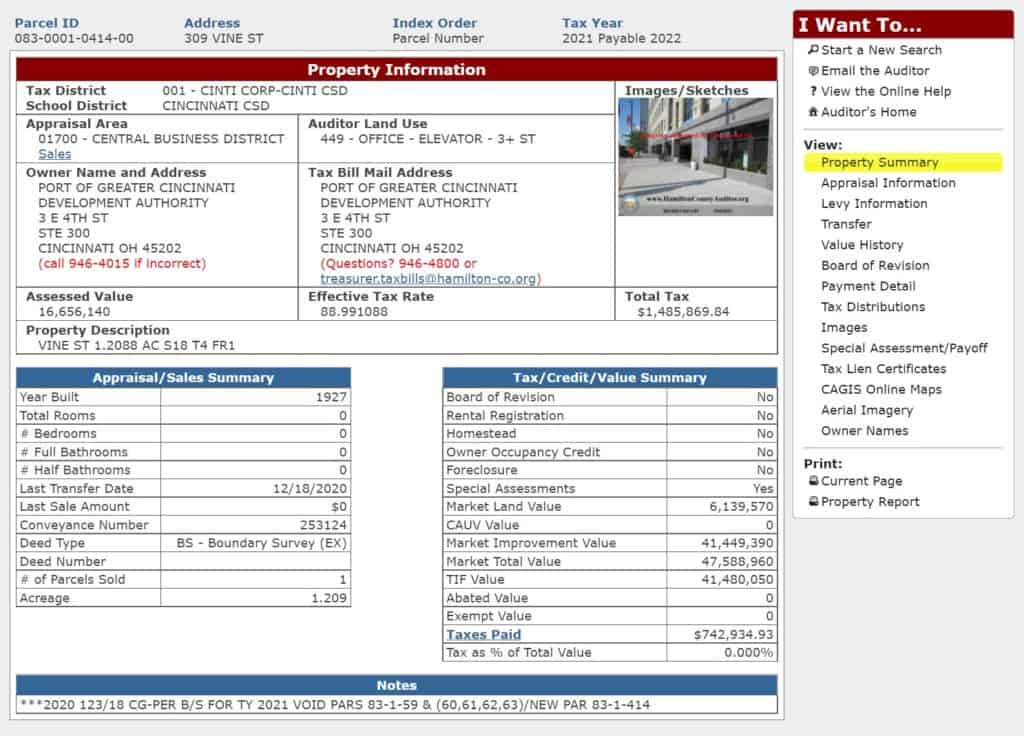

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Ohio Revenue Stamp Prepaid Sales Tax Receipt 9 Cents B3l Ebay

Online Services Business Taxes Department Of Taxation

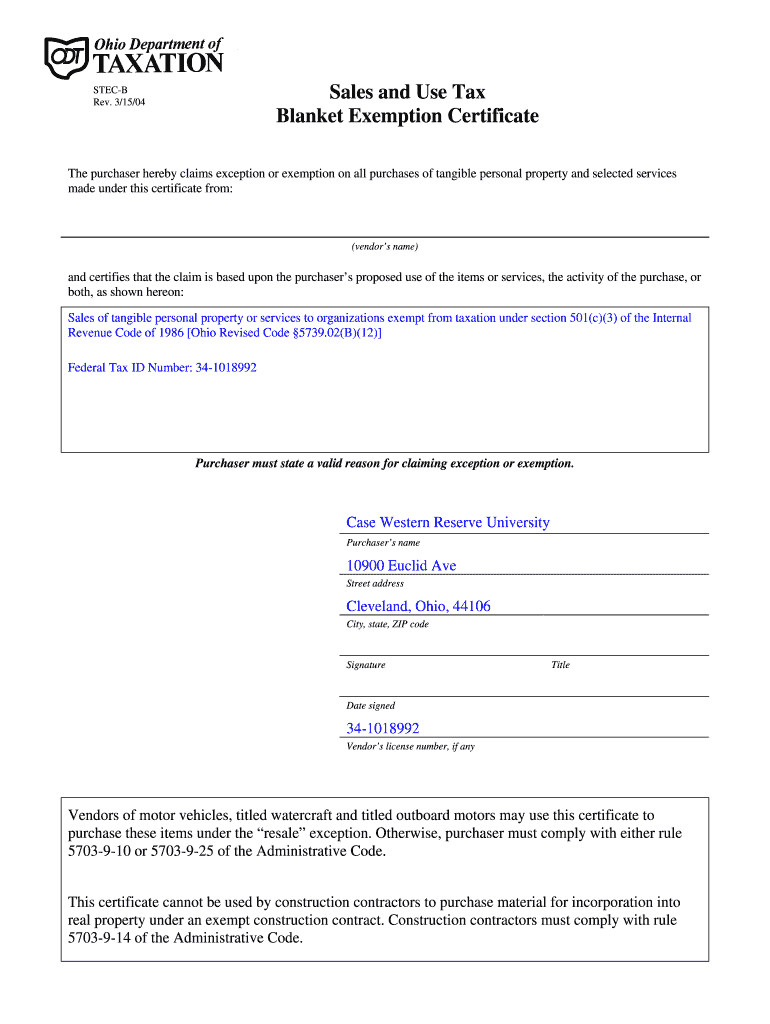

Case Western Tax Exempt Certificate Fill And Sign Printable Template Online Us Legal Forms

New Vendor Sales Tax Basics Diane M Werner C P M Ohio Department Of Taxation Akron Service Center Ppt Download

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Ohio In No Rush To Act On Supreme Court Sales Tax Case

Sales Tax By State Is Saas Taxable Taxjar

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Ohio Sales Tax Small Business Guide Truic

Ohio Sales Permit Equine Affaire

State Of Ohio Prepaid Sales Tax Consumer S Receipt 3 Cents Ebay